What You’ll Learn

What a debt to income (DTI) ratio is

Why DTI matters when buying a home

How to calculate your DTI

What mortgage lenders consider a good DTI and how to lower yours

When you apply for a mortgage or any other type of loan, the top three things lenders look at are your income, your credit score, and your debt-to-income ratio, or DTI.

The first two are fairly self-explanatory—but what is DTI? And how do lenders use it in the mortgage process?

In short, your DTI is the balance between all the money you have coming in every month (income) and how much you’re obliged to pay every month to creditors (debt). This helps lenders know how safe or risky it would be to approve your loan.

Below, we’ll help you understand all the factors that make up your DTI, how to calculate it for yourself, and how to optimize it to get the best terms in your mortgage.

What is a debt to income ratio?

A DTI ratio simply represents how much of your gross monthly income is spoken for by creditors, and how much of it is left over to you as disposable income.

It’s most commonly written as a percentage. So, for example, if you pay half your monthly income in debt payments, you would have a DTI of 50%.

How to calculate debt to income ratio

Okay easy enough, but your ratio is likely not as clear-cut as “half your income” (and, as you’ll see later on, ideally it’ll be much less). How do you calculate your exact DTI? There’s math involved, but thankfully it’s pretty basic (no trigonometry required).

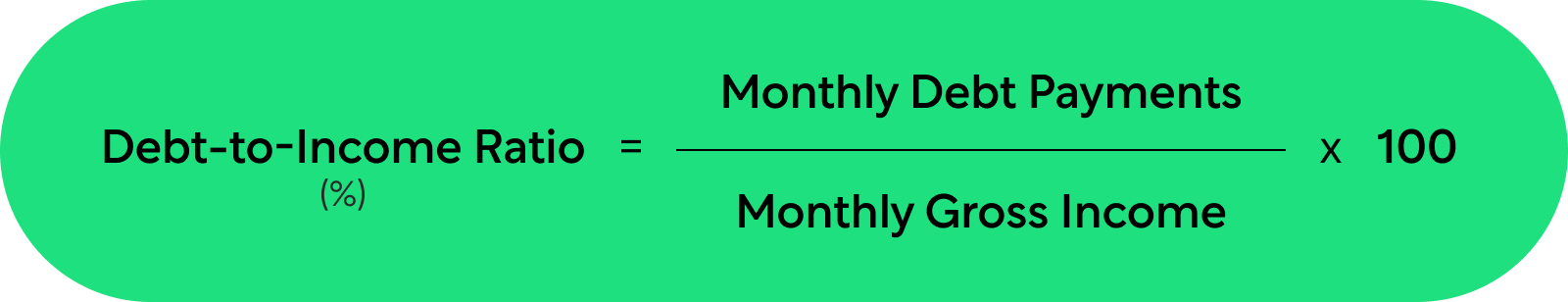

Simply divide all your monthly debt payments by your gross (pre-tax) income, and then multiply that number by 100. This will give you your DTI percentage.

In some cases, what constitutes “income” and “debts” is clear-cut. In other cases, not so much. Generally, lenders follow these guidelines for what to include for each.

Debt includes:

- Future or estimated monthly housing expenses (mortgage payment, homeowners insurance, property taxes)

- Student loans

- Auto loans

- Personal loans

- Minimum required credit card payments

Income includes:

- Pre-tax monthly salary (determined by dividing your annual salary by 12)

- Income from additional jobs or side hustles

- Revenue from rental property or other investments

- Regular income from annuities, trust funds, and retirement accounts

- Any child support or alimony payments you receive

Let’s look at a real-world example:

Auto loan: $350 per month

Student loans: $220 per month

Credit cards: $130 minimum monthly payment

Expected housing costs: $1,800 per month

= $2,500 monthly debt obligation

Monthly salary: 5,000 ($60,000 divided by 12)

Monthly side-gig income: $1,500

= $6,500 monthly income

[ 2,500 / 6,500 = 0.38 ] x 100 = 38% DTI

The above scenario is for illustrative purposes only.

What should your DTI be to buy a home?

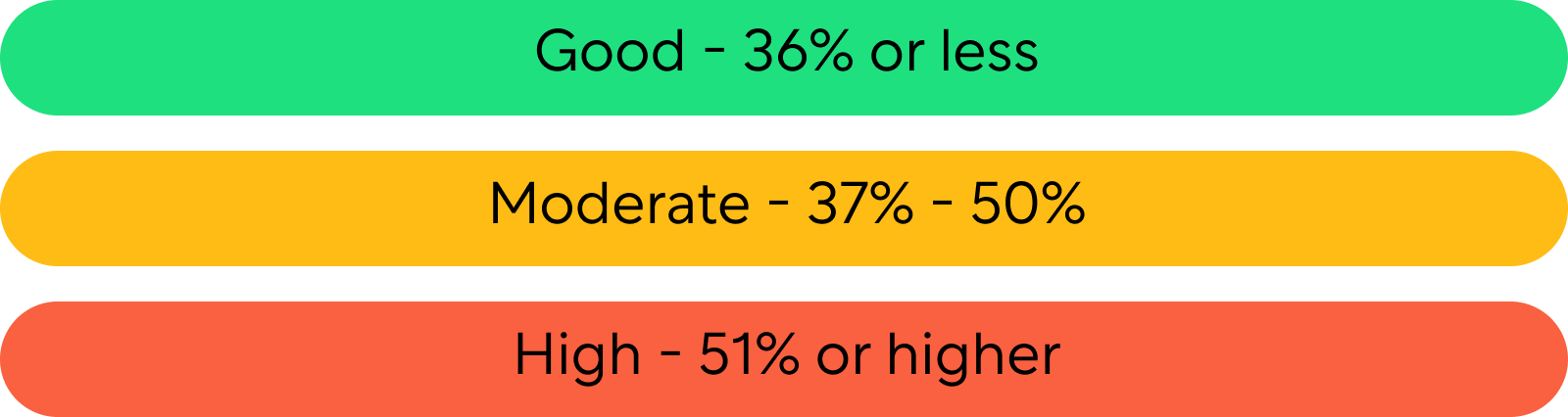

The lower your DTI, the better—this means less of your income is tied to recurring debt payments, and you’ll likely be more able to continue making payments on time even if you experience a minor financial setback. Borrowers with higher debt obligations relative to their incomes are less able to absorb those setbacks, and are at greater risk of defaulting on their loan. This is why high DTI is the #1 reason mortgage applications get rejected.

So, what’s the magic number when it comes to DTI? Well, it varies slightly based on the type of mortgage, the lender, and other aspects of your financial profile.

Typically, though, most lenders prefer to see a DTI of under 36%. In other words, the total of your monthly debts, including your estimated monthly mortgage payment, will be less than 36% of your monthly gross income. However, it may be possible to get a mortgage with a DTI of up to 50% depending on the lender. If you have a DTI of 50% or higher, then it could be challenging or even impossible to get approved for a mortgage until you lower your debt to income ratio.

Conventional loan DTI requirements

A conventional mortgage is a home loan offered by a private lender—such as a bank or a mortgage company. Private lenders tend to have a little wiggle room when it comes to DTI, depending on the exact loan you’re applying for and your personal situation. But that wiggle room can only go so far, because DTI requirements are typically based on policies created by government-backed lenders like Fannie Mae in order to protect customers.

While many lenders require a DTI of no more than 43%, some lenders, including Better Mortgage, can provide mortgages to borrowers with DTIs up to 50%. This means even if your DTI is 49.999%, you could be eligible for a home mortgage loan.

FHA loan DTI requirements

FHA loans are mortgages backed by the Federal Housing Administration (FHA) and offered by an approved list of lenders (including Better Mortgage). The FHA is a government organization that insures these loans if their borrowers default.

FHA mortgages require a lower minimum down payment and credit score than many conventional loans. This flexibility helps make homeownership more attainable for first-time homebuyers or those with lower income levels who may be ineligible for conventional loans.

The maximum DTI for FHA loans is usually up to 50%, though this may go higher if you can meet other compensating factors.

How to lower your DTI ratio

If you’ve run the numbers and you’re concerned that your DTI isn’t as low as you’d like it to be, there are two main ways you can decrease it: reduce your debt or increase your income. Lowering your DTI can make the mortgage process go smoother, so it might be worthwhile if you have time before you apply for a new mortgage or refinance.

Here are a few DTI reduction strategies to consider:

- Pay down or pay off your car loan before applying for your mortgage.

- Start paying off your credit cards in full, one by one. (Just don’t close the cards after you pay them off, as this can hurt your credit score.)

- If possible, refinance or consolidate current loans to reduce your monthly payments.

- Consider adding a co-borrower with a low DTI to your loan.

- Pick up a side gig or part-time job to help pay down debt.

- Expecting a raise or promotion in the next few months? Consider waiting to apply until it goes through.

- Consider using some of your down payment savings to pay down debt. Just make sure you’ll meet down payment guidelines, which can be as little as 3% to 5%.

Get clarity on your DTI with a pre-approval

At Better, we want you to be as prepared for buying a home and the mortgage process as possible.

Applying for a pre-approval takes as little as 3 minutes and will provide you with a clear picture of how much you can afford. You’ll undergo a soft credit check (which doesn’t affect your score) that allows our underwriters to look at your debts, income, and credit in detail to obtain a more accurate picture of your DTI.

Although your DTI ratio is just one important factor to consider when buying a home, carrying less debt relative to your income will make it easier to get a mortgage and help ensure you’ll be able to afford your home for years to come.

Better Mortgage can help you understand your DTI and the financing options available to you. Start your pre-approval process today.

- Tags:

- Privacy

- Technology