What You’ll Learn

Mortgage rates are on the rise, but still lower than historic highs

Research finds that the more lenders you shop with, the more potential for savings

Even a slight percentage difference in mortgage rates can add up to big savings

If you’re in the process of searching for a new home, then news of rising interest rates might be a little unsettling.

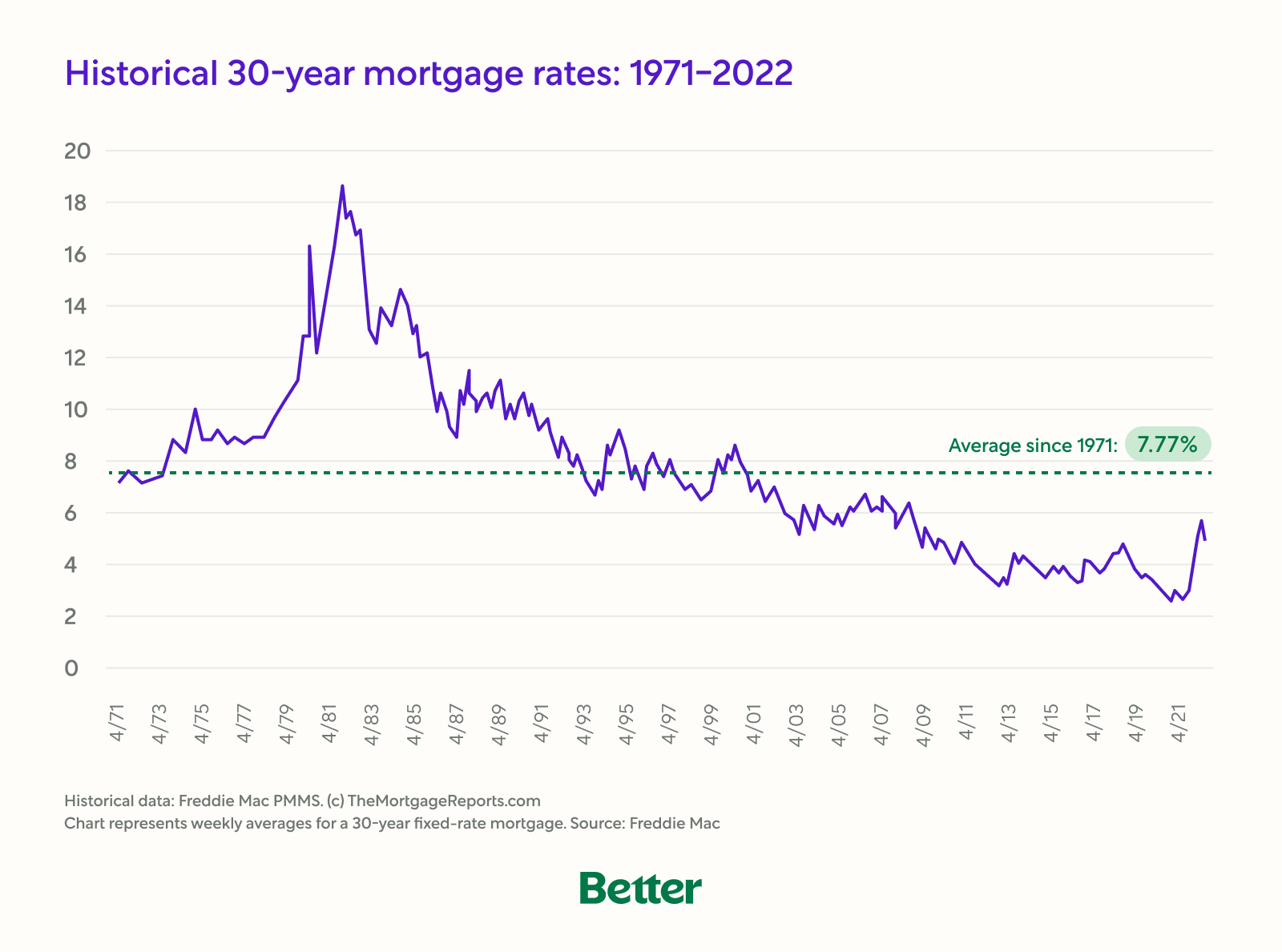

Although rates have been creeping up, the good news is they’re still nowhere near historic highs. In fact, when looking back over the past 50 years, today’s mortgage rates are well below the average.

Still, higher rates could result in increased mortgage costs for homebuyers. Therefore, it’s more important than ever to ensure you’re shopping around for the best mortgage rate with different lenders.

Not all lenders offer the same rates and benefits, so homebuyers who skip rate shopping could end up paying (quite literally) for it in the end.

A recent survey also found that 56% of all homebuyers don’t compare mortgage lenders before locking in an interest rate — a mistake that could equate to significantly higher mortgage costs over time.

So, here’s an overview on how to shop around and ensure you’re not overpaying on your mortgage.

Get started with Better Mortgage

Why you should look before you lock

Rate shopping is the practice of checking with several lenders and comparing their offered terms.

When you contact each lender, you’ll need to submit financial information regarding your income, employment, and outstanding debts to get pre-approved. Lenders will also need to pull your credit score to confirm the mortgage rates and terms you’ll be eligible for.

(You can get pre-approved with Better Mortgage in as little as 3 minutes! And it won’t ding your credit. Many lenders use a hard credit check at this stage, which may impact your credit score)

While every new hard credit inquiry typically lowers your score by a few points, there is an exception when it comes to mortgage rate shopping. All pulls within a 30-day window count as a single inquiry—as long as they’re all for a mortgage and not other debt.

Here’s what to do when shopping for a mortgage:

- Compare rates by speaking to at least three lenders (five or more is even better).

- Limit your shopping to a 30-day timespan to avoid damage to your credit score.

- Try multiple sources, including big banks, local lenders, and online lenders.

- Don’t consider a rate to be accurate until after you’re pre-approved (otherwise, it’s just a rough estimate).

Once you find a rate that fits your needs, you may want to consider “locking it in” to make it official. Locking an interest rate means you’ll be guaranteed the lower rate even if rates rise due to market conditions. Rate locks typically last between 30 to 60 days, which should be enough time to make it to the closing table. (In this competitive market, Better Mortgage let’s you lock a rate for 90 days to give you extra time to find a home, so you can shop with peace of mind.)

Experts anticipate the 30-year fixed mortgage rate could be as high as 7% by the end of 2022. That’s why locking in a rate today can save you from tomorrow’s higher interest rates.

Shopping around could save you substantially

You might think that a fraction of a percent won’t make a huge difference in payments over the lifetime of a mortgage. But the truth is, even a 0.50% difference in interest rate can greatly affect your monthly payments and long-term costs.

Let’s say that Nora is buying her first home and will need a mortgage of $300,000. She’s searching for rates and has two options to choose from. The first lender offers a 30-year fixed rate of 5.50%, while the second lender quotes a 30-year fixed rate of 5.00%.

Disclaimer: Based on a $300,000 home. Image and figures displayed are for illustrative purposes only. These do not reflect current mortgage rates. Your rates, cost and loan amount will vary. Monthly mortgage payment excludes taxes and insurance. Nora is not an actual Better Mortgage customer.

By shopping around and choosing the lender with the lower rate, Nora can save almost $100 a month and more than $30,000 over the life of her mortgage.

While even comparing two lenders could mean significant savings, shopping with multiple lenders further improves your chances. A Freddie Mac survey found that you’re more likely to secure a lower interest rate when you shop with more lenders. While borrowers who got one extra rate quote still saved, those who got five quotes saved nearly three times as much.

Get started with Better Mortgage

Other benefits of shopping around

Shopping for a mortgage isn’t just about comparing monthly payments and lifetime interest (even though these savings can be impressive). Here are other ways shopping for a mortgage can save you at the closing table and beyond:

- Closing costs: Closing costs range from 3% to 6% of a home’s purchase price. Closing fees vary by state, loan type, and mortgage lender. When shopping around for interest rates, compare closing costs as well.

- Additional fees: There are a multitude of potential fees that lenders can charge. While some are required, others are typically built in to increase profit. Some lenders (like Better Mortgage) charge only the necessary fees and skip commission and lender costs, providing clients with a better experience and value.

- Time: Not all lenders move at the same pace. When you’re in a rush to make it to the closing table, having a lender on your side who’s capable of working quickly is crucial. Shopping for rates can also give you insight into multiple lenders’ processes and timetables, helping you see who can keep up.

Ensure you’re comparing apples to apples

There are many different types of mortgages. Terms, fees, and rates vary for them all. It’s important to remember this when shopping for a loan rate. Comparing a 30-year mortgage rate with one lender to a 15-year mortgage rate with another won’t give you an accurate picture of where you’re saving.

A great way to compare loans is by using the Better Mortgage loan comparison calculator. By putting in the different terms of two separate mortgages, you can quickly compare monthly payments and lifetime costs to ensure you’re getting the best deal possible.

Lock a low rate with Better Mortgage

As mortgage rates rise, it’s crucial to compare lenders before locking a rate.

Are you ready to lock in a low mortgage rate and save? See your personalized rates when you get pre-approved with Better Mortgage in as little as 3 minutes.

Start the mortgage application process today.

- Tags:

- Branding

- Business

- Developing